Pricey quality homes to outperform lower end of market in coming twelve months

Several residential property analysts predict property price declines of 5 to 10 per cent in the coming twelve months. Their predictions follow steep mortgage rises from an average of 1.5 per cent early 2021 to between 4 to 6 percent in recent weeks,

Those forecasts, however, should be seen in perspective. On average UK house and apartment prices surged by 20 per cent from the start of the pandemic in 2020 and peaked in August 2022. Since then UK prices, on average have already fallen by 4 to 5 per cent to an average of around 282,000 pounds ($340,000) Halifax, Britain’s largest mortgage lender, estimated mid February.

Moreover, the predictions only cover part of the story, assuming Bank of England (BOE) and the International Monetary Fund (IMF) are correct in forecasting that there will be a shallow recession at worst.

Both seller agents and buyer consultants report that quality apartments and houses in London and popular south of England areas are in short supply

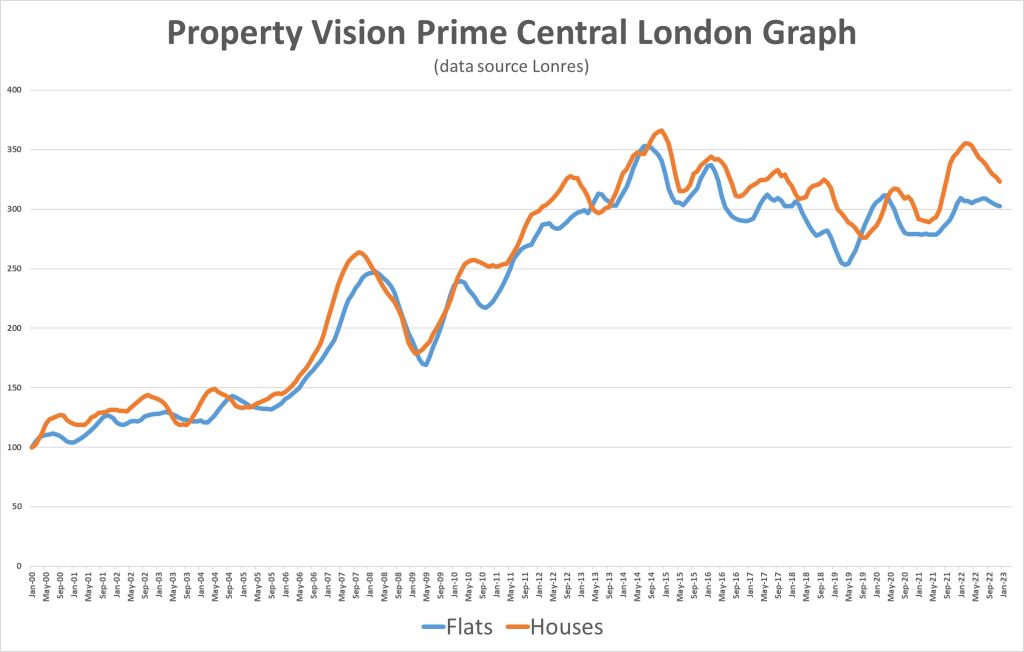

“They will be underpinned by demand from wealthy local and foreign buyers who have more than adequate spare cash,” contends Philip Harvey, a senior partner at Property Vision, a buy side advisor that specialises in prime London and country houses from £2 million ($2.4 m) to £50 million ($63 m) plus. In contrast, lower priced properties ranging between £250,000 to £600,000 will be vulnerable to further falls because of higher mortgage rates and surge in energy and other costs, he says.

“I’m not bearish, but am concerned about first time buyers who bought overpriced properties and underestimated refurbishment and other costs and problems,” he said. “Re-mortgaging will hurt people who have leveraged the most.”

In contrast cash rich buyers from New York who, for example, are keen on Georgian Town houses, are seeking opportunities. Others include Middle Eastern buyers following the oil price surge while there is continual interest from Hong Kong and Singapore, he says.

“The London property market has started the year better than expected,” stated Tom Bill, head of UK residential research at Knight Frank, a sales agent. From data in the past ten years, “the third week of 2023 experienced the fourth highest number of offers accepted in London during a single week in January.”

He added that the London sales market is also benefitting from a return to more urban living as the pandemic winds down in the UK.

Trends throughout UK

Simon Rubinsohn, chief economist at the Royal Institute of Chartered Surveyor (RICS) was cautious about potential difficulties in the UK residential market this year.

“The volume of deals is well down but that’s not surprising as buyers are uncertain and are waiting for predicted declines and sellers are reluctant to reduce offer prices,” he said.

A RICS survey of members in December showed that across the UK, net new buyer enquiries were minus 39 per cent, similarly to November 2022. This signalled ongoing weakness in demand. The number of fresh property listings fell by 23 per cent. Supplies are also down as developers, faced with higher materials and wage costs, are delaying building. A national net balance of 42 per cent of respondents reported a decline in prices a further weakening relative to 26 per cent in the November survey.

Mortgage approvals for house purchase fell to just 35,600 in December, the lowest level since May 2020, according to Bank of England figures. Approvals for remortgaging fell to 26,100, from 32,600 in November, the lowest level since January 2013.

Despite these disappointing trends, the current property climate, “does not feel like the downturns subsequent to the great financial crisis of 2008 and 2009; nor the slides in the early 1990s and 1980s”, Rubinsohn said.

“Yes, there will continue to be an adjustment because mortgage rates have risen, but so far there are no signs of distress selling from owners who had down payments of only 10 per cent,” he continued. “Unemployment is low and there are plenty of job vacancies.”

Rental Market

Average UK rentals, which have risen from around 980 pounds in the fourth quarter of 2020 and were just under 1200 pounds in the fourth quarter of 2022 will rise by a further 10 per cent in 2023, predicts JLL, the international real estate firm.

London has a different tenure profile to other parts of the country, according to Knight Frank. The firm estimates that 29 per cent of homes are rented in London compared to 17 per cent in the rest of England.

© copyright Neil Behrmann. A version of this article has been published in The Business Times Singapore . For other Asian and global articles try https://subscribe.sph.com.sg/publications-bt/