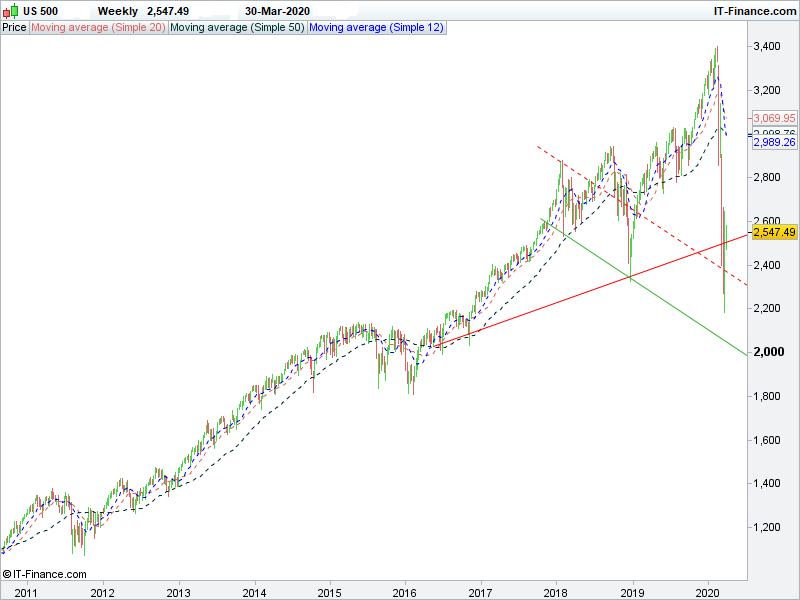

Beware of “bull traps”. As opposed to previous bear markets this one is the combination of health, business and financial worries.

The bear market of 2020 is very different from its predecessors.

Bubbles ending in busts, credit crises and wars caused previous market slumps. This time round, a global health pandemic pushed the longest bull market in history over a steep cliff.

Such is the volatility that losses on Wall Street, London, European, Asian and other exchanges have ranged between 20 and 30 per cent. High frequency and other hedge funds worsen investors’ problems as their algorithmic models make markets more unpredictable.

Oversold markets have rallied steeply, but sceptical traders fear that there will be another downward wave. If they prove to be correct a further slide to new lows may create a bear market that is one of the worst in history.

Everything but the kitchen sink to save economies

As opposed to previous bear markets, the current turmoil is the combination of health, business and financial worries. The uncertainty is whether frantic international government efforts to isolate people and shut down businesses, travel and entertainment will defeat COVID-19; whether a vaccine will be found swiftly; and how soon life will normalise.

The US, UK, France and other governments and central banks are throwing everything but the kitchen sink at economies. They hope to counter recessionary damage from supply cutbacks and falling demand. But the massive credit and bailouts of over-borrowed corporations and struggling workers will come at a huge cost.

Sovereign and Corporate debt dangers

Several economists predict stagflation, i.e. recession combined with inflation. In those circumstances, short- and long-term interest rates would rise and place pressure on corporations and individuals with excessive debt. Companies are already stopping share buybacks and dividends are being cut. Historic earnings estimates, PE ratios and other indicators are now meaningless. In short, stock market weakness could recur in this economic and financial environment .

The surge in the US dollar does not help as that raises the multi-trillion foreign debt burden of emerging and other nations. The latest Bank for International Settlements (BIS) report estimates that US dollar credit to foreign non-bank borrowers rose by 5 per cent year on year to $12.1 trillion at the end of September 2019. Over and above that credit, euro and yen borrowing was equivalent to $1.8 trillion. This raises total foreign borrowing of Asian and other emerging nations to $13.9 trillion. Within the total foreign credit range, the emerging market proportion was $3.8 trillion.

This is a major reason why bargain hunters are at risk in this wildly fluctuating market.

The bear markets in the 1970s illustrate the pitfalls

Bear markets include the 2008 to 2009 financial crisis, the 2000 to 2001 Nasdaq tumble and the 1997 Asian crisis. Market veterans, however, believe that the current slump is similar to bear markets during the 1970s, while the speed of the fall can be compared to the 1987 crash.

Compared with the boom in the 1960s, stock markets were fraught in the 1970s. There were two severe bear markets, several major rallies and smaller ups and downs. Basically the market went nowhere for more than a decade. The next bull market began in August 1982.

There was a stock market boom in the 1960s after then-president John F Kennedy pursued Keynesian economic pump priming. His successor Lyndon Johnson continued with a spending spree to finance the Vietnam war, and the S&P 500 index soared by 126 per cent to a peak of 791 points late 1968. But a nasty bear market followed, and the index fell by 36 per cent and bottomed in mid-1970. Then came a relatively small bull market with a 30 per cent increase in the index.

The oil shock is closest comparison to COVID-19 shock

In 1973, however, the Yom Kippur War changed the global economic and financial landscape. Middle Eastern producers formed the OPEC club and an oil shock took hold. Prices soared from around $3 a barrel to around $14. Inflation and interest rates surged to levels of more than 10 per cent. The S&P 500 index slumped by 51 per cent. Global markets followed Wall Street and in the UK, a coal miner strike caused power cuts.

In the wintry New Year weather of early 1974, people in British offices worked in candlelight. The UK, in particular, experienced an awful recession that included commercial and residential property slides and a banking crisis. In the following years, the market went up and down with steep rallies and slides. Performance was inconsistent. Some traders made profits, others losses. Long term investors were frustrated.

For insight into booms and busts take a look at Neil’s books. They can easily be found via his author page on Amazon https://www.amazon.co.uk/Neil-Behrmann/e/B005HA9E3M Neil’s financial thrillers Trader Jack- The Story of Jack Miner and its sequel Jack of Diamonds have had excellent reviews which include comments on the in-depth research into gold and gold share trading, diamond markets and financial bubbles and crashes. Children 8 to 12 have also enjoyed the anti-war fantasy, Butterfly Battle- The Story of the Great Insect War. It had exceptional reviews.

High Inflation and interest rates didn’t help

Exceedingly high inflation continued and Paul Volcker, the US Federal Reserve Bank chairman, slammed on the monetary brakes. The yield on US 10-year treasury bonds touched 14 per cent in 1981; and in a final horrid slump, the S&P index tumbled well below the 1968 top. In 1982 the S&P 500 index began a lengthy recovery, albeit with a severe short, sharp 34 per cent crash in 1987. But it was only in 1992 that the market finally recovered to the peak that was last seen in 1968.

Neither buy too high nor too soon

That market history shows that equities, similar to any other investment, should not be bought when they are overvalued. It can take a lengthy time to recover losses if the asset is bought at or near the peak.

Fortunes can be made if the investor buys near the bottom. But there is also a danger of buying too soon. It is a matter of simple arithmetic. Say a stock slumps by 80 per cent from 100 and the investor thinks, wow, at 20 it is a good buy. A few weeks later the stock falls further and from the very top, the decline is 90 per cent. But if the bargain hunter had bought the stock at 20 ( i.e. 80 per cent from the top) and it has fallen to 10 ( i.e. 90 per cent from the peak), the investor would be down by 50 per cent. To recover his loss, the stock must then rise by 100 per cent.

In bull markets, professional and amateur investors may think of themselves as financial wizards. In bear markets, only the very nimble traders can win. But luck must be on their side.

© Neil Behrmann— first published in The Business Times Singapore