Massive bear positions in US futures, options helped pound gold to the worst levels in a year.

But there are signs that the bears are beginning to cover their shorts. The standard mantra of precious metals analysts is that the strong US dollar pushed gold down to a 2018 low last Thursday. Another key reason, however, has been a massive increase in bearish positions on derivative exchanges.

Latest figures by the Commodity Futures Trading Commission (CFTC) on Aug 14 show that net gold shorts – bear positions in futures and options on US derivatives exchanges – totalled 108,960 contracts down from a record 116,960. Since each contract represents 100 ounces of gold, the net bear positions are still equivalent to almost 11 million ounces.

This adds up to 130.9 million ounces in total. In other words, the net bear position is equivalent to 8.5 per cent of last year’s annual physical gold demand. The build-up in short positions of hedge and commodity trading funds as well as merchants and producers has taken several months.

The breakdown, according to the CFTC, is net 77,273 contracts of fund managers speculative short positions and 39,687 net short hedge positions of merchants, mines and refineries. These bear positions have so far been exceedingly profitable for the fund speculators and provided insurance against a price decline for mines and other producers.

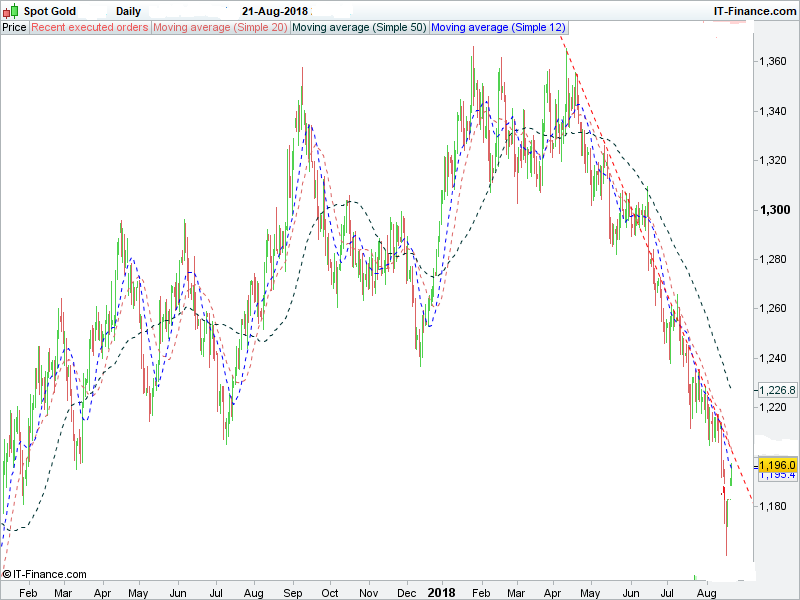

Only this week was there a sign that the bears have begun to close their positions by buying back their gold futures and options. In only a few days gold has shot up from$1160 an ounce last Thursday, August 17 to $1196 on Tuesday August 22. The chart shows, however, that gold is still heavily oversold.

According to market sources, the bears are betting on a further rise of the US dollar. They are taking the view that Turkish and other emerging nation dollar borrowers need to repay their loans and will have to purchase the US currency.

The gold bears also contend that stronger stock markets could maintain unpopularity of precious metals.

On the other hand, bullish dealers feel that gold has already fallen in terms of all currencies and is now oversold and relatively cheap.

From April, when the international gold reached its 2018 peak of US$1,365 an ounce, it tumbled by 15 per cent to last week’s $1160 low point. China and India are by far the most significant jewellery buyers and hoarders. Despite their currency devaluations, gold priced in Indian rupees has fallen by 7.7 per cent since April and in yuan terms by 7.1 per cent.

The Singapore dollar price has declined by 10.5 per cent, the yen by 7.5 per cent, the euro by 7 per cent and the pound by 5.3 per cent.

This price fall places less strain on jewellers and other buyers who need to purchase gold for the upcoming seasons of Diwali in India, Christmas and Chinese New Year.

The massive, record short gold derivative bear positions of 117 million ounces can be regarded as a “coiled spring” of potential purchases.

Gold has surged by 21.5 per cent in Turkish liras as the currency has collapsed. Despite the price rise, however, the Turkish populace have been buying gold as a hedge against hyperinflation.

In the past few years, Turkey’s central bank has steadily been buying gold and in June its gold reserves had risen to 7.7 million ounces.

US President Donald Trump’s induced trade war is likely to come to a negotiated end at some point and there are already indications of a meeting between the US and China in late August.

If there is a settlement, there would be less economic pressure on China and Europe. Hopefully, Turkey would follow.

The panic on loan repayments could end for a while, causing emerging market currencies to stabilise. The US dollar could then peak and possibly fall.

In such circumstances, the spring would uncoil into a swift, potentially steep rally when gold shorts are forced to buy back their derivatives. The question following the 3 per cent rally in the past few days, is whether Asian physical gold buyers will squeeze the bears further.

A gold price recovery should also boost prices of silver and platinum. There are also extensive short, bear futures and options positions in those precious metals.

This article was first published in The Business Times, Singapore

Neil Behrmann is London correspondent of The Business Times. Jack of Diamonds his thriller on global diamond mining and smuggling, has recently been published. It is the sequel to the thriller, Trader Jack, The Story of Jack Miner.

See reviews of both books: https://www.amazon.co.uk/Neil-Behrmann/e/B005HA9E3M