Implications for Emerging markets serious

THE failure of the Chinese and Indian authorities to clear up fraud and corruption, is hurting growth.

China’s so-called “shadow banking” comprises complicated, unregulated loans and wealth products. The system is widely regarded as the economy’s Achilles heel.

Indian banks’ non-performing loans are estimated at US$147 billion. The number of banking fraud and corruption cases are mounting by the day.

Reform of China’s shadow banking will initially squeeze borrowers

China’s fraud and corruption are endemic, according to a study by Ernst & Young. China’s Central Commission for Discipline Inspection issued over 450,000 disciplinary penalties. Judicial authorities investigated 11,000 people.

The Bank for International Settlements (BIS) has published a paper on the nation’s unstable shadow banking. It is rife with speculation, gambling and alleged fraud.

The BIS finds that the loans, bonds and wealth products are complex and opaque. So much so, that it is difficult to gauge the extent of the problem.

The BIS estimates that shadow “bankers acceptances, trust & entrusted loans, informal lending, wealth management products, trust investments and bonds, total 40.8 trillion yuan ($6.5 trillion). It reckons that the size of shadow banking assets rose by 25 per cent in 2016. They accounted for 55 per cent of China’s gross domestic product.

Research and writing take time, but articles on this blog are free. They are here to give you in depth information and ideas. In return, kindly browse the books pages. Please read the blurb and preliminary reviews of my latest book, Jack of Diamonds . It will soon be published. The thriller is a stand alone sequel of Trader Jack-The Story of Jack Miner which had excellent reviews. Butterfly Battle-The Story of the Great Insect War is very different. It is anti-war and for boys & girls, 8-12. School teachers, librarians praised it and children loved it.

“The big surprise for most foreign investors will be moves to clean up shadow banking,” contends Simon Hunt of Simon Hunt Strategic Services. “The National People’s Congress (NPC) meeting in March will point the way ahead.”

Mr Hunt, who visits China regularly, maintains that the government seizure of Anbang Insurance Group is the start of the cleansing.

Anbang chairman Wu Xiaohui, has been charged with economic crimes. The government claims that Anbang, owner of the Waldorf Hotel, Dutch and other global insurance companies, broke the law. It fears that Anbang will be unable to meet its obligations.

The China Insurance Regulatory Commission has also issued notices to major insurers Ping An Insurance, New China Life Insurance and China Re Asset Management.

The regulator alleges that the insurance companies’ overseas companies have violated foreign deal regulations.

Altering a shadow banking system with assets of variable quality, will be a tough adjustment. Credit is already exceptionally tight for private and state-owned enterprises. Mr Hunt predicts a slowdown in the first half. He hopes that conversion of shadow banking into the regulated financial system, will precipitate responsible lending and economic growth. Other economists fear a prolonged adjustment and slack economy. Property prices are falling and manufacturing slowed down in February.

India’s alleged debt fraud crisis is worsening.

Punjab National Bank estimates that potential losses from the alleged loan fraud involving billionaire diamond jeweller Nirav Modi’s gem companies has risen by $200 million to $2 billion.

Meanwhile, Firestar Diamond, a US company of Mr Modi, has filed for Chapter 11 bankruptcy. Assets are listed in court documents at $50 million to $100 million.

India’s Central Bureau of Investigation (CBI) has also searched offices of Mr Modi’s lawyers, Cyril Amarchand Mangaldas. Despite complaints about threats to client-attorney confidentiality, CBI seized Mr Modi’s documents & assets.

An Indian specialist money laundering court has also ruled that the authorities could ask foreign courts to identify and seize Mr Modi’s properties, other assets and documents.

Judge M S Azmi gave permission to instruct China, the US, UAE, UK, Singapore and South Africa to hand over assets. Mr Modi has denied any wrongdoing.

Whistleblowers have gone on record on India’s Republic TV, alleging that the alleged diamond debt scam is much bigger and broader.

In a separate development, Sarine Technologies, the Israeli firm listed in Singapore, filed a lawsuit against Indian manufacturer Rose Gems. It alleged breach of contract, fraud and copyright infringement.

According to a survey by Kroll, the global investigative firm, India has experienced a significant increase in scams.

Eighty-nine per cent of respondents in Indian organisations said that they had experienced a fraud incident in the past 12 months.

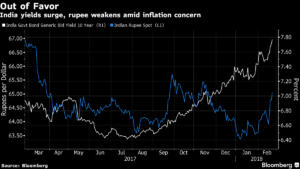

The credit fraud crisis could not have come at a worse time. India’s recession risk has risen. Inflation has accelerated to 5 per cent.

The Reserve Bank of India has stepped up surveillance of the US$147 billion doubtful loans. Short and long-term interest rates have jumped, causing a slide in bond prices.

The expectation is that struggling banks, under tighter supervision, will cut lending. Higher rates will also squeeze businesses and indebted consumers.

This article first appeared in The Business Times Singapore